Samarco

Ahead of Creditors Meeting, Samarco and Ad Hoc Group Make Preliminary Contact Amid Continued Tension Between Parties as Speculation About Alternative Creditor Proposal Mounts

Fri 09/03/2021 16:10 PM

After signing nondisclosure agreements, advisors for Samarco and those representing the ad hoc creditor group have engaged in preliminary contact ahead of a general creditors’ assembly, which has been scheduled for October, sources close to the situation told Reorg.

It is unclear exactly to what extent substantive discussions have taken or will take place. One of the sources said, however, that it is safe to assume that the company will have the benefit of evaluating a counterproposal to the debtors’ plan put forward in June prior to the general creditors’ assembly.

Other sources suggested the company is ready to engage with creditors, but the ad hoc group is favoring a legal strategy, based on litigation, with one of the sources questioning whether the group’s attempts to engage with the debtor are genuine. Separate sources close to the group pushed back against that suggestion, saying the litigation has been focused on specific points of law and is a parallel workstream and complaining that Samarco has not been proactive about due diligence and the amount of information shared with the group after signing the nondisclosure agreement, or NDA.

Three sources suggested the group’s strategy is to reject a debtor plan and propose their own, though others stated it might be too early to rule out engagement between the parties or a negotiation process, which could also result in the general creditors’ assembly being suspended to allow more time for discussion. Possible adjournments were also included as a possibility in a timeline of proceedings shared with members of the ad hoc group, seen by Reorg.

As it stands, creditors are unhappy with the Brazilian miner’s plano de recuperação judicial, or RJ plan, filed in June, considering it gives creditors an option to choose between i) an 85% haircut and 1% late payment interest over the course of 20 years and ii) an exchange of claims for Class B junior preferred equity, whereby ownership would be diluted by existing shareholders Vale and BHP, which also have claims that are classified as unsecured.

Under the deal, Vale and BHP also maintain the right – along with creditors and potential third parties – to participate in a new-money offering involving preferred equity that would rank senior to the Class B preferreds.

The plan represents a large gap compared with what had been proposed by the company during prepetition restructuring talks, which was included in blow-out materials published after talks failed, some of the sources noted.

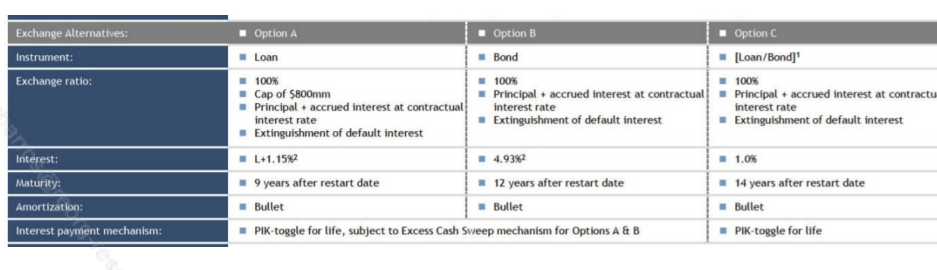

Samarco’s original November 2018 term sheet proposed to exchange all loan export prepayment agreement facilities, and international bonds, into any one of three exchange alternatives, none of which involved a potential haircut:

Under Samarco’s Dec. 19, 2019, counterproposal, option B was a PIK 5.25%/4.93% cash PIK-toggle bond with the toggle option lasting for life.

At the time, those materials included a letter, among other documents, revealing that the creditors wanted shareholder debentures and the claims arising from the contributions made from shareholders Vale and BHP to the Fundação Renova, or Renova Foundation, to be equitized or structurally subordinated.

Under each of Samarco’s proposals, the Renova obligations and shareholder debentures were ranked pari passu with options A and B.

Samarco’s in-court restructuring is likely to test amendments to Brazil’s insolvency law, following a reform early this year, including express provisions giving creditors the ability to file alternative restructuring plans in certain circumstances. If the parties cannot come to an agreement, the ad hoc group will likely work to file an alternative RJ plan, with sources saying that they are assuming that creditor-side lawyers are already working with that scenario as a possibility.

Considering the prepetition discussions between the parties, an alternative creditor plan could involve an exchange of existing unsecured claims for take-back paper that is senior to at least the shareholder debentures (and/or the Renova claims), and is structured such that it is likely to trade, as opposed to junior preferred equity that may be relatively illiquid. An alternate plan could also involve the potential to participate in a rights offering for pro forma equity.

Considering the principle of par condicio creditorum – related to parity of treatment among equivalent creditors and described as a foundational concept of Brazil’s insolvency law, alsoreferred to as the pari passu rule – subordination of claims within a specific creditor class may attract litigation.

According to two sources close to the situation, while the law contains express provisions under which shareholder loans are subordinate in some cases in the context of a liquidation, in an RJ scenario, equity claims would likely need to be negotiated as subordinate under a plan. Some have questioned the group’s likelihood of success in subordinating those claims under an alternative plan.

Voting Procedure and Trustee Change

As reported, voting thresholds for approving a debtor-proposed plan and those that would follow an alternative creditor plan under certain procedures differ, according to the April 19 declaration of Fábio Rosas, of Cescon, Barrieu, Flesch & Barreto Advogados.

One of the relevant questions ahead of the general creditors’ assembly is whether the ad hoc group will have a majority, per the RJ law rules, to either block and/or propose an alternative plan. While the composition of the group is unclear, sources told Reorg that there is currently a cohesive bloc with crossover between holders of the notes and the EPP debt issued by Samarco. One of the sources suggested the group holds a majority of the company debt and would therefore in theory have a blocking stake.

In fact, a majority of Samarco noteholders on Aug. 25 decided, in compliance with the procedure provided for in the indentures governing Samarco’s international unsecured bonds issued in 2012, 2013, and 2014, to replace bond trustee BNY Mellon with UMB Bank. According to the prospectus governing Samarco’s bonds maturing in 2024, only a majority in aggregate principal amount of the outstanding notes may replace the trustee and appoint a successor, as reported.

Ana Carolina Monteiro, head of restructuring and insolvency at Kincaid Mendes Vianna Advogados, in an interview with Reorg suggested that the development is indicative of the strength of the ad hoc group in terms of holding a majority of Samarco’s debt.

“The replacement of BNY Mellon by UMB BANK NA points to an unfavorable imbalance for the approval of the RJ plan presented by Samarco. This is because UMB joins funds York Global Finance, Ashmore, Solus and City National, which seek substantial change to the Plan. This is the moment for an incisive reaction by the debtor and its shareholders so that their participation in the vote is guaranteed by the court, under threat of a rejection of the plan and a possible hostile takeover,” Monteiro told Reorg.

Considering that voting rules in RJ include majority in both number and face value, a procedure is under way in parallel for the individualization of bondholder creditors following a request, as reported, by Samarco’s administradores judiciais, or judicial administrators. Oi SA’s RJ providedimportant precedent regarding the individualization of claims for voting purposes in which the judge recognized the legitimacy of the right for individual beneficiaries to vote as part of an RJ plan.

Shareholder Voting Rights

Another key question relates to the rights for shareholders Vale and BHP to vote on an RJ plan or an alternative creditor plan. The shareholders have provided continuous periodic funds to Renova under the terms of the transaction and adjustment term of conduct, or TTAC, through Samarco, giving rise to Renova reimbursement obligations, or RROs. Samarco’s creditor list includes 11.931 billion Brazilian reais (about $228 million) and BRL 11.819 billion of Class III unsecured claims from Vale and BHP, respectively.

Article 43 of Brazil’s insolvency law imposes limits on the ability of shareholder creditors and related parties to vote in a debtor RJ plan in certain situations, including if the shareholder holds more than 10% of the company’s share capital. Brazil’s bankruptcy law did not expressly address the issue in the context of an alternative creditor plan, and therefore this is likely to be litigated, two sources explained, which could result in a ruling against the creditors on voting procedures in an alternative plan.

Strictly speaking, per Brazil’s insolvency law, shareholders do not vote because Vale and BHP are not creditors – unless their participation in the company’s capital would arise from an event that would trigger a debt action against Samarco, according to Monteiro of Kincaid Mendes.

Further, it is possible that Vale and BHP would be considered to have a conflict of interest if they were to participate in the voting procedure due to a simultaneous role as shareholders as well as creditors in Samarco, according to Monteiro.

“However, in my opinion, this idea present in article art. 43, of Law 11,101/2005 is questionable, since shareholders, notably Vale and BHP, may have claims against the company arising from civil liability.

On those grounds, your right to vote in a creditors’ meetings, in my view, would be guaranteed, unless it can be determined that there is an obvious conflict of interest. If that is the case, then the shareholder votes could be considered abusive and, per Article 58, would be disregarded by the courts through a cram down procedure,” Monteiro said.

Such a conflict of interest would need to be shown by arguing that, for example, Vale and BHP as controlling shareholders have influence on the company’s management and on the plan’s conditions.

This influence would have to be demonstrated in court, according to Monteiro.

She added that the Minas Gerais courts have previously allowed a creditor shareholder to vote in a general creditors’ meeting. In a 2013 appeal in the RJ of Cia Industrial Itaunense, Judge Luís Carlos Gambogi stated that Brazil’s insolvency law does not preclude a shareholder who is also a creditor from participating in the general creditors’ meeting, including the right to vote in an RJ plan.

Of course, the Samarco RJ is a different case with its own characteristics and, therefore, the courts must analyze the origin of the shareholders’ credits as well as any possible conflicts of interest in order to grant them the right to vote, Monteiro added.

Furthermore, one might be able to argue that the same logic regarding shareholder votes might apply to qualified bondholders who would be entitled, under a plan, to convert their debt into shares.

A source close to the company noted that litigation around abuse of process is to be expected as the company is planning to mount legal challenges on that front.

A separate legal source mentioned that past São Paulo in-court restructurings, including the RJ of Wow Nutrition, could also represent legal precedents. In that case, it was determined that any interference from the shareholder in a restructuring would need to be analyzed after a vote takes place to understand if there was any conflict that would justify the suspension of shareholder voting rights. The case discussed the idea that beyond looking at specific share capital percentages, any decision regarding the suspension of shareholder votes would need to be looked at in the context of the specific case, based on perceived undue interference with the debtor’s insolvency, the source

added.

Another scenario could involve creditors successfully cramming down shareholders in an alternative creditor plan situation, two sources said. Within that context, it is not clear if all of the RROs should be counted for voting purposes or not, considering there is litigation about whether BHP and Vale share joint and several liability for all of those claims or only one-third of them, as included in a petition filed by the ad hoc group.

Sources following the situation have also expressed doubt about the ongoing TTAC renegotiations and how this might inform potential future restructuring issues. Importantly, the judge overseeing the restructuring has restricted any DIP proceeds to operations. The court determined that proceeds cannot be used to make payments to the Renova Foundation and instead must be directed to improving the company’s operational capacity and boosting cash flow.

Article 69-E of Brazil’s insolvency law provides that anyone can be a DIP lender, including prepetition lenders and debtor-shareholders, provided the negotiations are at arm’s length.

Following DIP proposals from the shareholders andcounterproposals from the ad hoc group of creditors, a court of appeals judge last month ordered Samarco to reopen the competitive process to find a provider of its debtor-in-possession, or DIP, loan, according to court documents.

Separately, the Minas Gerais state public prosecutors, or MPMG, have asked for a court order allowing for proprietary actions to be taken against Samarco as well as for the RJ to be thrown out.

The prosecutors allege misuse of power, which a recent court decision considered. Importantly, the court recognized that the MPMG held the right to bring the action – as a legitimate party – against Samarco, citing Brazil’s civil code. The judge did not allow for the company’s assets to be seized as per the request of the Tribunal de Justiça de Minas Gerais, or TJMG, and the court stated that Vale and BHP’s assets are “infinitely superior” to the credits under Samarco’s RJ, suggesting there is capability on the part of the shareholders to cover those amounts (thereby making any assets

seizures unnecessary.) The MPMG can appeal the decision.

In terms of next steps, the new law also provides for a 90-day limit to conclude creditors’ meetings duly installed. Based on a general timeline of proceedings shared with members of the ad hoc group, seen by Reorg, we estimate that a creditors’ meeting vote rejecting the plan could take place only in January 2022, with a potential filing of the creditors’ plan 30 days after that.

As reported, there are two scenarios under which creditors will be able to file alternative plans: If the debtors’ plan filed within the exclusivity period is not voted on by the end of the stay period (180 days, which can be extended for another 180 days), or if the debtors’ plan is voted on and rejected.

Under the new law, as reported, there are also some restrictions that are imposed on the creditors’ plan. For example:

Creditors would not be able to force shareholders to capitalize the company; and

The plan cannot place the debtors and the shareholders in a position that is worse than they would be in a hypothetical bankruptcy liquidation.

- There is room for debate, however, on exactly what this last provision means including, for example, whether the hypothetical bankruptcy liquidation should be considered in the context of equity only or equity plus prepetition loans, or if postpetition loans should also be included in the hypothetical liquidation.

- A spokesperson for Samarco did not respond to a number of points raised in this article. A spokesperson for the group did not immediately respond to a request for comment.

–Roberto Barros

This publication has been prepared by Reorg Research, Inc. or one of its a%iliates (collectively, “Reorg”) and is being provided to the recipient in connection with a subscription to one or more Reorg products. Recipient’s use of the Reorg platform is subject to Reorg’s Terms of Use or the user agreement pursuant to which the recipient has access to the platform (the “Applicable Terms”). The recipient of this publication may not redistribute or republish any portion of the information contained herein other than with Reorg’s express written consent or in accordance with the Applicable Terms. The information in this publication is for general informational purposes only and should not be construed as legal, investment, accounting or other professional advice on any subject matter or as a substitute for such advice. The recipient of this publication must comply with all applicable laws, including laws regarding the purchase and sale of securities. Reorg obtains information from a wide variety of sources, which it believes to be reliable, but Reorg does not make any representation, warranty, or certification as to the materiality or public availability of the information in this publication or that such information is accurate, complete, comprehensive or fit for a particular purpose. Recipients

must make their own decisions about investment strategies or securities mentioned in this publication. Reorg and its o%icers, directors, partners and employees expressly disclaim all liability relating to or arising from actions taken or not taken based on any or all of the information contained in this publication. © 2021 Reorg.

All rights reserved. Reorg® is a registered trademark of Reorg Research, Inc.

© Copyright 2012 – 2021